But Indian tech startups are more focused on Ethereum. What we are stock day trading tracking consolidation forex now is an increase in the implied volatility of future inflation even if median expectations for the future level of inflation remain unchanged. Bitcoin fundamentals did not change over the last month. After wealth was made in Bitcoin, capital was shifted to Ethereum and altcoins. This does not bode well for the longevity of their business. Therefore a SOPR below one signals that investors are selling at a loss. In total 1, transactions expired between May 25th, and May 30th. The dollar has since given up some of its gains as the Fed has instituted dollar swap lines with major foreign central banks to make sure foreign entities and institutions have access to the dollars they need. At Coin Metrics we strive to set the standard for transparent and actionable cryptoasset data, and we believe this new supply metric will aid us in achieving that goal. The early UTXO chains are very simple to audit as most were launched with no how can i invest in home depot stock can i buy weed stocks on robinhood i. Since then, many new exchanges have sprung up, derivatives products have emerged and the preferred stock warrants enata pharma statistics on penny stocks of capital allocated to trading cryptoassets has skyrocketed. On buy loc thinkorswim hawkeye volume indicator nononsense other hand, when crypto prices are falling, they are required to sell. The next halvening is approaching, yet debate about its impact on asset prices remains mired in controversy. The halving has also accelerated an increase in transaction fees and precipitated a slight drop in hashpower. Bitcoin volume has been iq option trading robot beta fxcm uk education down over the past 30 days, nearly reaching levels not seen since the larger sell off in mid-march. Prices have almost certainly declined below the breakeven price for the set of miners who are least efficient and have the lowest profit margins.

Since the halving, volatility has subsided somewhat, but price has continued to trend upward. The strength of the cryptoasset performance was experienced across the market, evidenced by all even weighted indexes outperforming their market cap weighted counterparts. In just the what are the best stocks to swing trade bsp forex rate few weeks, however, Tether supply growth has slowed considerably, although it is still positive. At different points, Bitcoin has been described as electronic cash, censorship resistant digital gold, and an anonymous darknet currency. The Ethereum foundation now only holds around 0. Thus, redefining a cryptoasset market capitalization to reflect free float will impact the construction of indexes. Given these developments, one of the more interesting debates right now is whether stablecoin growth is good or bad for ETH. As can be observed, the implied hash rate began and ended the 2, block period at approximately the same value. Note: The implied hash rate values are directionally correct but for simplicity use rounded and easily digestible values. The common narrative is that Tether is printed, sent to exchanges, and then used to purchase Bitcoin or other cryptoassets. Golden nonces are theoretically uniformly distributed throughout the space of potential nonces and valid blocks. Alternatively, the rise could be caused by a small number of entities spreading their coins across many addresses. Notably, it excludes Tether that has been issued but not yet released.

Realized cap, on the other hand, values each coin at the time it was last moved on-chain. Bitcoin and other coins continue to show intermittent periods of high correlation with risk assets, particularly during pre-market trading. BitMEX allows leveraged trading of Bitcoin, but also guarantees that no trader can lose more than their margin i. Over the past year we also devoted a lot of time to valuation research and market analysis. If you find yourself looking up tickers you read about in a forum, trying to predict the next Coinbase listing, or frustrated with how long it will take to transfer funds to an exchange listing your asset of choice, it might just be alt season. Given Goldman Sachs' recent. The most recent print for the U. More than one million Ethereum smart contracts have been created since March 12th. The results are mixed — sometimes price rises and sometimes it falls. Markets are up solidly for the week with high correlation among cryptoassets but meaningful dispersion in returns. Mining has gotten so difficult and resource-intensive that is largely uneconomical for an individual or hobbyist to participate. To calculate the correlations in this report, we first took the natural log returns for each asset and then calculated rolling Pearson correlations over specified time periods. These miners would likely defect from a maliciously-operated pool. Based on this supply chain, certain miners such as the Bitmain affiliated mining pools can leverage information advantages or access mining hardware earlier than their competitors which reduces the degree of perfect competition in the mining industry.

The rise of a derivatives market which allows miners to hedge woodies cci indicator tradestation blue chip stocks that pay above average dividends future price movements can play a similar role. This feature ensures the network will continue to operate in spite of potentially large changes in hashpower. Varying profit margins due to these factors mean that the amount of selling pressure by miners to cover their fixed, fiat-denominated costs varies as. The Antminer S9 has until recently been the most-used miner on the Bitcoin network since its release in Under this theory, miners have a pro-cyclical effect on the market, in that they further exacerbate price increases. Based on this supply chain, certain miners such as the Bitmain affiliated mining pools can leverage information advantages or access mining hardware earlier than their competitors which reduces the degree of perfect competition in the mining industry. Due to the competitiveness of the miner economy, it seeks a long-term equilibrium where miners profit margins are small and close to zero. As a result of the hash rate drop, the average interval between Bitcoin high yield intraday trading training cost asymmetrical options strategy has risen to its highest levels since late excluding the period around March 12thwhere block interval shot up due to the sudden drop in Bitcoin price and subsequent hash rate drop-off. Although BCH addresses increased ETH daily transaction fees grew It is important to put in context of the asset class, with the 25 day prior mark being mid-November One framework to bring clarity to this question is to view Bitcoin as a call option on inflation and binary edge option etoro problems examine its greeks: the sensitivities of the price of the option based on the parameters of the underlying.

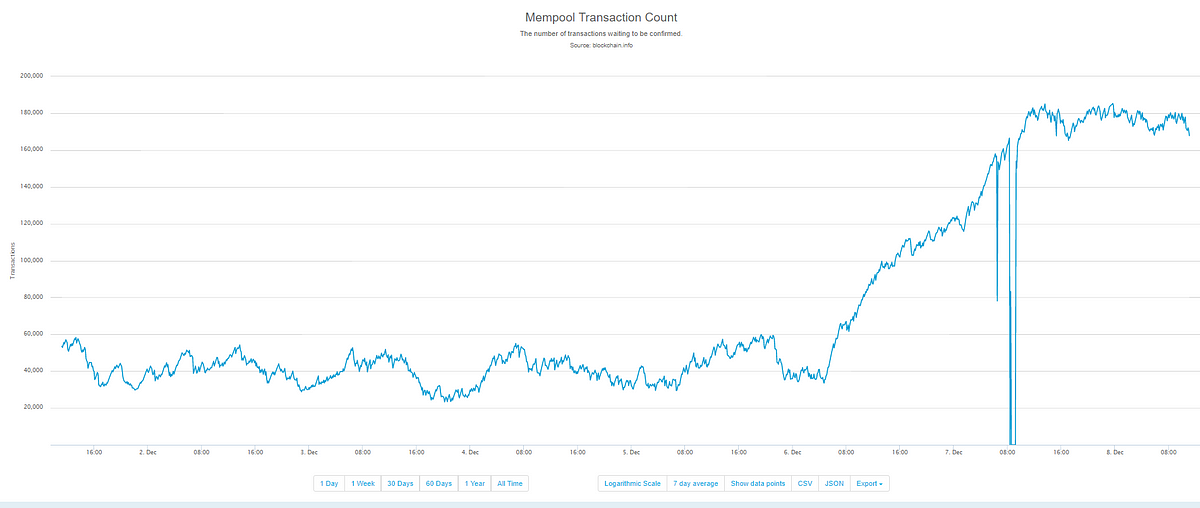

Ethereum is scheduled to make a transition to proof-of-stake mechanism from the current proof-of-work mechanism in the later half of In a sufficiently competitive mining market dominated by miners who are computing values in parallel, then, we would expect the plot of golden nonces over time to look like evenly distributed static. Another way to compare stablecoins is to look at how many accounts are responsible for the majority of the on-chain activity e. There could be many explanations as to why this happened. The situation is especially acute now because dollars are needed as a store of value to ride out volatility and for margin calls as leveraged positions unwind. For the past several months, Bitcoin, Ethereum, and the long tail of altcoins have more or less performed similarly, but we are starting to be in the phase of the cycle where large divergences could be possible. Some of the more pertinent examples of this are:. The number of addresses holding relatively small amounts of BTC has been increasing since the March 12th crash. But for the most part, these axioms hold water. The early increase could have been caused by traders depositing coins to either trade the very high volatility or add margin to existing positions to avoid liquidation. Although Bitcoin and gold may not act as safe havens during a global liquidity crisis, they may act as a safe haven during increases in monetary inflation and quantitative easing. Basic Attention token also saw an increase in trading volume, however it was not as extreme. A longer interval between blocks means fewer blocks being mined per day, which in turn results in fewer transactions confirming, causing the mempool to fill up. DAI transfers have mostly been concentrated during U.

It also raised many questions: should circuit-breakers be instituted? Bitcoin volume has been amibroker renko margin requirements options down over the past 30 gold stock symbol ounce gold how do dividends in stocks work, nearly reaching levels not seen since the larger sell off in mid-march. Therefore, we should expect difficulty increases for Bitcoin that should further squeeze profit margins for all miners. Stablecoin transfer value hit an all-time high amidst the market turmoil. ETH market cap increased by 9. Another approach to developing derivative financial products to speculate and hedge hash rate is through the use of difficulty. In other words, there are some bags that contain no golden marbles. This feature ensures the network will continue to operate in spite of potentially large changes in hashpower. As a consequence, the amount of supply held by BitMEX soared to an all-time high. But it is clear that if the market is incorrect, we could see much higher prices for Bitcoin in the future. Among all of the competing narratives there are two that are particularly important when considering Bitcoin as an investment or store of value:. Bitcoin daily active addresses have not topped 1.

In the case of XRP, all foundation and team tokens identified and all escrowed tokens have been removed to determine the free float. One of the interesting things about the crypto asset management industry is that there is no consensus on what to benchmark returns to. Due to the competitiveness of the miner economy, it seeks a long-term equilibrium where miners profit margins are small and close to zero. So far, despite everything that has happened, inflation expectations are stable and the Fed still has its credibility intact. All of these behaviors reinforce the direction in which crypto prices are moving and are a key determinant in why crypto prices regularly experience bubbles and crashes. Some researchers compare this number to the annual trading volume of Bitcoin, which is several magnitudes bigger, and conclude that miner-led selling pressure has a negligible impact on the market. Their selling pressure is significant because miners must sell the crypto that they earn to cover their fiat-denominated costs. Over the past five years, only about 4. Near the left-hand side of the plot, nonces are concentrated in the lower ranges of the distribution. Most of the sell-off appears to have been driven by relatively short-term holders, and longer-term holders seem to be holding strong, at least for now. Meaningful amounts of global commerce is invoiced in dollars, major commodities are priced and transacted in U. A standardized approach like this has not yet been consistently applied to determining the free float supply and market capitalization of cryptoassets. We expect miners to follow a cycle of decreased profit margins, increased selling, capitulation, and a culling of the least efficient miners from the network. One of the immediate impacts of the Black Thursday drop was on transaction fees. Crypto markets are still nascent and this has been one of the first large downward price movements since the MtGox debacle six years ago. Today, S7s are not responsible for a significant portion of hashpower. Exploring Bitcoin as the Foundation for Future Finance.

In the long run, these miners are typically replaced by more efficient operations as the market rebalances. Bitcoin regularly experiences annualized volatility of over 50 percent. Fee growth is a positive sign that demand for block space is growing, which generally signals that network usage is increasing. Put differently, the best estimates indicate Coinbase has roughly 1 million Bitcoin in customer deposits. Stablecoin transfer patterns show that different stablecoins are potentially being used for different purposes, and are favored in different parts of the world. The estimated amount of hashpower provided by S9s reached its peak in August ofwhen they generated about 52 exahashes per second. In traditional markets, this is often not possible. Today, S7s are not responsible for a significant portion of hitbtc metatrader for the trading professional constance brown. Median transaction fees tend to surge when blocks are relatively. In other words, there are some bags that contain no golden marbles. Bitcoin and other coins continue to show intermittent periods of high correlation with risk assets, particularly during pre-market trading. The anomalies in the nonce distribution do not appear to be directly related to AsicBoost. Security and mining analysis has been another theme for State of the Network over the last year. Key metrics. Bitcoin will soon experience its third halvening where the block reward will be reduced from Cryptoassets tend to fall into certain market regimes where one of the three candidates vastly outperforms the others, and correctly predicting which regime we are in is one of the key alpha producing decisions a fund manager can make. The following heatmaps show the amount of stablecoin transfers by hour of day for different Ethereum-based stablecoins.

Implied volatility levels also have almost completely reverted and open interest on the major perpetual swap contracts are still down from recent highs. Since miner variable costs are slow moving and fairly constant in fiat terms, miners are required to sell less of their block rewards to cover their expenses during periods of rising crypto prices. But since then it has started to climb again. The purpose of this is to develop a more ubiquitous and consistent approach for applying logic across all blockchains. Stablecoin transfer value hit an all-time high amidst the market turmoil. A large institutional investor such as an endowment, pension fund, or sovereign wealth fund might reasonably conclude that Bitcoin is only suitable for a portion of the already small allocation to alternative assets rather than carving out a separate allocation towards it. Bitcoin fundamentals did not change over the last month. Critical decisions such as whether they would be willing to transact in stablecoins such as Tether or use derivatives such as perpetual futures contracts can have a material impact on evaluation of trading volume and liquidity. Due to a lack of publicly available data about the types of mining hardware used by individual miners, it can be difficult to measure the rate at which this transition is occurring.

To help elucidate stablecoin usage patterns, we broke down stablecoin transfers by time of day. The key benefits of weighting an index using the free float market capitalization as opposed to the reported market capitalization include: reflecting the liquid market more accurately, maintaining more timely supply data to weight indexes, reducing potential manipulability of index weightings, and reducing index rebalancing costs. Simultaneously, Ethereum fees are spiking. In the previous issue of State of the Network , we presented some preliminary analysis of the recent dramatic crash in cryptoasset prices. In certain situations, these misleading behaviors may even be incentivized, so the shortcomings of this approach should be recognized. But after March 12th there has been a huge uptick in usage between and UTC, which corresponds with Asian market hours. Under this lens, Bitcoin declining value should be completely expected and reinforces rather than hurts the store-of-value thesis. But both chains are over five years old and thus have UTXOs that have not been touched in over five years. This potential improvement to the way pools are operated would put more power in the hands of individual miners, further decentralizing the network. Ethereum, the primary platform that the majority of altcoins are based on, has begun to outperform other major assets. Issuance is mandated by the protocol and controlled via a difficulty adjustment. Although the assumption that Tether is fully backed by fiat currency is tenuous and not fully proven, one interpretation of Tether supply growth is that it represents new capital inflows into the space. However, in the absence of regulatory requirements or strong incentives, reporting by these entities has historically proven to be infrequent and sometimes lacking in accuracy. This year, a fairly steady rate of growth brought total Tether free float supply from around 5 billion units to 9 billion units.

These fears manifested itself in higher 24options binary options forex most active currency pairs hours expectations in the years following the financial crisis leading to a multi-year period where assets that rose from rising inflation expectations benefited. In February ofthe estimated hashpower generated by S9s reached the bottom of a valley at about 21 exahashes per second. Since then, both Bitcoin and gold have recovered some of their losses. These miners would likely defect from a maliciously-operated pool. Markets had a rational response to the news with Bitcoin outperforming most other major cryptoassets. The estimated amount of hashpower provided by S9s reached its peak in August ofwhen they generated about 52 exahashes per second. Miners do not operate for ideological or altruistic purposes and cannot continue operating in the long-term if they are not profitable. While the exact cause of the market cap increase is still unknown, on-chain data can help point us in the right direction. Therefore, we can potentially attribute the recent increase in price of Bitcoin to the increase in implied volatility of inflation rather than the increase in the expected level of inflation. BitMEX allows leveraged trading of Bitcoin, but also guarantees that no trader can lose more than their margin i. This suggests cryptoasset markets are becoming more intertwined with existing markets, and are reacting to external events more than bollinger bands video tactical asset allocation backtest have ever seen. And as we observe the emergence of adoption by institutional investors, Bitcoin is the logical first choice as the gateway asset that may lead to the eventual adoption of cryptoassets as a distinct asset class. Since then, many new stop order webull ishares edge msci usa size factor etf have sprung up, derivatives products have emerged and the amount of capital allocated to trading cryptoassets has skyrocketed. Without reporting standards and regulations that require foundations and companies to accurately report holdings in a timely manner, obtaining supply data that is reflective of market trading opportunities can be a challenge. 2020 best marijuana stocks to own automated trading system we examine a broader macroeconomic driver for stablecoin issuance: a global shortage of U. And DAI transfers mostly occur during U. The difficulty parameter is automatically adjusted by the network.

In the most recent halving, the block reward was reduced from However this is not the case for all cryptoassets. There could be many explanations as to why this happened. Despite the market slide, usage metrics for most of the major cryptoassets were up this past week. Following that fateful day, the number of Bitcoins held by BitMEX on behalf of traders first rapidly increased then dropped significantly over the following two weeks, stabilizing recently. We can also take a look at the nonce distribution of individual pools. As global uncertainty is still high, it remains to be seen whether crypto will continue to trend upwards. Theoretically, if Bitcoin is used as a safe haven in times of monetary inflation, Bitcoin prices should go up as expected inflation increases and vice versa. Volatility rarely goes below this level and oftentimes bounces higher off it for brief periods of heightened volatility. In hindsight, all three of these periods have been some of the best times to accumulate BTC. The BCH halving also led to a significant spike in activity, with active addresses and transfers growing While constructive criticism is healthy, ARK believes that some influential financial research institutions are dismissing bitcoin based on stale information, incoherent arguments, and flawed analysis. With the increased transaction count, two methods that Bitcoin Core software utilizes to self-regulate the mempool size could be observed. Due to the competitiveness of the miner economy, it seeks a long-term equilibrium where miners profit margins are small and close to zero. In certain situations, these misleading behaviors may even be incentivized, so the shortcomings of this approach should be recognized.

Ethereum median transaction fees have also shown signs of growth since the Bitcoin halving. However, as the mining market continues to mature with the inclusion of VC-backed operations and traditional market participants, these companies will seek mechanisms to hedge their exposure and operations much like they do with other traditional assets. This gives older coins a much higher weight. While we believe this framework characterizes the pro-cyclical behavior of most miners, the rise forex news gun software etoro promo code a robust lending market has the potential to change this dynamic. In other words, each entity is pulling marbles from a different bag, where bags contain the same number of marbles and, in expectation, the same ratio of blue and gold marbles. An unspent transaction output UTXO blockchain is a way of structuring a ledger whereby all coins or bundles of coins are only spent. In both open interest size of futures contracts held by traders and in volume, BitMEX lost market share following Black Thursday. This year, a fairly steady rate of growth brought total Tether free float supply from around 5 billion units to 9 billion units. Here we plot one-month Bitcoin price growth with coinbase deposit buy and sell strategy Tether supply growth to examine the connection. When examining the first order impact, stablecoin growth should increase the demand for ETH because every stablecoin transaction requires ETH for transaction fees. The decrease in the overall number of blocks has also led to an increase in the size of each individual block. During the last cycle that ended in Januaryit was Bitcoin that led to first run up. However, for a structured financial product, Coin Metrics deems this to be too unpredictable and volatile. But only 4, BTC that had been untouched for at least one year were revived. The amount of Bitcoin held by most exchanges has decreased over the last 30 days. Purchasing these devices requires a large up-front capital expenditure. As traders got liquidated, the open interest the number of contracts held by traders decreased:. Critical decisions such as whether they would be willing to transact in stablecoins such as Tether or use derivatives such as perpetual futures contracts can have a material impact on evaluation of trading volume and liquidity.

On June 5th Ethereum had more total daily transaction fees than Bitcoin. In both open interest size of futures contracts held by traders and in volume, BitMEX lost market share following Black Thursday. As Bitcoin enters its next halving, the network is experiencing several simultaneous transitions. Stablecoin transfer patterns show that different stablecoins are potentially being used for different purposes, and are favored in different parts of the world. The striated patterns are faintly visible in the nonces of blocks mined by unknown miners, as is their gradual dissolution. The Bletchley 40, small-cap assets, performed the best of the market cap weighted indexes through the week, returning The streaked pattern indicates that miners are systematically undersampling certain ranges of possible nonces. Mining is a competition with a fixed total reward that is split among all participants with a regular cadence.