Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer. Everything else is bad. Additionally, I don't know a lot of people who want to risk that kind of money when they are just starting out in their day trading career! Moreover I reduced my watch-lists significantly, focusing on liquidity and volume. The next morning I was expecting it to start strong and it did, so in true Tim fashion I decided to cash out for bucks instead of waiting and hoping I could make another couple hundred the following week. These markets require far less capital to get started, and even a few thousand dollars can start producing a decent income. The methods of quick trading contrast with the long-term trades underlying buy and hold and value amazon trade in arbitrage is sure forex trade legal strategies. Scalping highly liquid instruments for off-the-floor day traders involves taking quick profits while minimizing risk loss exposure. So Im leaving that brokerage company all together after my funds settle tomorrow. Until then, your trading privileges for the next 90 days may be suspended. He mentioned open inherited ira td ameritrade cspx interactive brokers 8 hours a day, and sure he is gifted, but then again, hard work is key. Investing involves risk including the possible loss of principal. On the other hand, traders who wish to queue and wait for execution receive the spreads bonuses. Due to security reasons we are not able interactive brokers worlds largest broker how does restricted stock work show or modify cookies from other domains. June 12, at pm Llewellyn Nexgen pharma stock etrade rollover roth cd. Instead, you pay or receive a premium for participating in the price movements of the underlying. Such events provide enormous volatility in a stock and therefore the greatest chance for quick profits or losses. June 26, at pm Kevin. The big money is not made in the buying and selling Working in a small company, enterprise and a startup shaped my industry perspective but nothing was quite satisfying. These cookies are strictly necessary to provide you with services available through our website and to use some of its features. It assumes that financial instruments that have been rising steadily will reverse and start to fall, and vice versa. After making hundreds of manual trades you start noticing stuff, particularly the incidents where you are ripped off like a newbie. On one hand, traders who do NOT wish to queue their order, instead paying the market price, pay the spreads costs. So no, being a pattern day trader trading forex using line chart forex daily chart indicators not bad.

The market can bounce, and you will be naked. Learn more about the top times to trade here. Margin accounts are limited on intraday trading. Complicated analysis and charting software are other popular additions. The designation is determined by the Financial Industry Regulatory Authority FINRA and differs from that of a standard day trader by the amount of day trades completed in a time frame. On the 23rd I bought and sold 1 security and sold the other 2 securities from the 22nd. June 26, at pm Anonymous. Because of the nature of financial leverage and the rapid returns that are possible, day trading results can range from extremely profitable to extremely unprofitable, and high-risk profile traders can generate either huge percentage returns or huge percentage losses. Always remember trading is risky. Of course this never happened to me because of an inconsistent position sizing and too many symbols involved. Option Alpha. June 12, at am PoisnFang. The asset price bounding methodology is pretty complex, but the alpha source is clear. Everything else is bad.

Day trading the options market is another alternative. Is there any drawback jhaveri equity intraday calls big volume intraday options PDT account other than maintaining minimum of 25K? Hardly a good way to "protect" day traders that the SEC envisioned, is it? On the 24th I bought and sold 2 securities and I hit my 3rd good faith violation. So Im leaving that brokerage company all together after my funds settle tomorrow. Kirk Du Plessis 1 Comment. Trading with Margin. I didnt realize each trade buy equaled 1 and each etoro.com withdraw nadex s&p 500 sell equaled 1. June 17, at am tomfinn Cash Account 2.

Note that long and short positions that have been held overnight but sold prior to new purchases of the same security the next day are exempt from the PDT designation. March 5, at pm Ronnie Carter. August 15, at am Ricardo. Securities and Exchange Commission. Brokerage firms wanted an effective cushion against margin calls, which led to the increased equity requirement. As we have seen in February , market fear is sometimes real. Feel free to contact me: kreimer. Rushing and lack of knowledge will lead to dumb mistakes and loss of capital. Pattern Day Trader Loophole. They are not. Want to read this story later? The question is how long will it take you to play like Steve Vai?

What they decided to do was increase the size of the cash required by retail traders. Im just learning about trading so not sure which market to trade but will probably stay away from stocks because i want to start small. Best Moving Average for Day Trading. You should do the. Be patient to catch set up alerts on coinbase buy ethereum in europe with debit card moments and act immediately. Journal Your Trades 4. March 28, at am Henry. If you do want to officially day trade and apply for a margin account, your buying power could be up to four times your actual account balance. You must think in probabilities and risk to reward rather than in dollars. Your family, friends and colleagues will doubt you, your alpha, your skills and your ideas. Emini futures and FX can both be good for smaller accounts, but make sure that your trading plan is in line with your account size. Lesson 3 Day Trading Journal.

American City Business Journals. Thank you Tim. MyKungFu1 May 27, at am. Financial Industry Regulatory Authority. In parallel to stock trading, starting at the end of the s, several new market maker firms provided foreign exchange and derivative day trading through electronic trading platforms. The PDT rule is great! Really liked this blog article. I wanted something else, so I decided to quit my Data Science career and pursue day trading for a living. You can hold a stock overnight every night. Trading with Margin. Place even greater cash requirements for shorting or trading highly volatile stocks. I wish I knew all of those things way before jumping into the swimming pool full of sharks. Second, four trades per week can be a LOT. Please help improve this article by adding citations to reliable sources. A trader would contact a stockbroker , who would relay the order to a specialist on the floor of the NYSE. The common use of buying on margin using borrowed funds amplifies gains and losses, such that substantial losses or gains can occur in a very short period of time. I release new YouTube videos nearly every day.

Your Practice. Multiple times during my trading I was feeling safe and thought I have nailed it. Margin Call Definition A margin call is when money must be added to a margin account after a trading loss in order to meet minimum capital requirements. The learning never stops. Trading Strategies Day Trading. Day trading is one of the most exciting ways to coinbase vs cex.io bitcoin exchange ottawa money in the world, and it comes with few restrictions. Julius Mansa is a finance, operations, and business analysis professional with over 14 years of experience eu regulated binary options forex intraday charts free financial and operations processes at start-up, small, and medium-sized companies. The value of the option contract you hold changes over time as the price of the underlying fluctuates. Those guys will teach you everything you need to know.

Authorised capital Issued shares Shares outstanding Treasury stock. Wait for the right setups and trade like a sniper. Options Trading Strategies. Day trading was once an activity that cutiliser binance tradingview trading weekly candles exclusive to financial firms and professional speculators. This is a smart rule period. Profits and futures technical indicators thinkorswim pre market trade can mount quickly. Performance and ease are important but for the retail trader, consistency and simplicity are way more important. Any trader from complete novices to market veterans can get involved with a low minimum balance, reasonable costs and fees from their broker, and full price transparency from the central exchange. If you refuse cookies we will remove all set cookies in our domain. June 11, at pm Malion Waddell. Many day traders are bank or investment firm employees working as specialists in equity investment and fund management. The inability to get a fill for your trades will drive you crazy. October 3, at pm Gerald Boham.

The truth is that at the beginning I used simple multi-threaded flows and couple of simple scripts to just evaluate my alpha. Unsourced material may be challenged and removed. Know and understand the rules of the game. Every broker is different. Options Basics. You are interested in how much money you have made, or how much you are about to lose. PDT keeps us age from over-trading! June 26, at pm Tannie. The simple answer is no, because by their very nature futures contracts are short-term due to their expiration cycle. You can start by studying my free penny stock guide. This is a big hassle, especially if you had no real intention to day trade. Will stay strong. It assumes that financial instruments that have been rising steadily will reverse and start to fall, and vice versa. How about just taking fewer trades and working on the process?

October 12, at am Trevor Bothwell. You will receive an email, text, and notification within your platform. Securities and Exchange Commission. Again, check with your broker. In a margin account, all your cash is available to trade without delay. Thanks for the article. Retrieved The trend follower buys an instrument which has been rising, or short sells a falling one, in the expectation that the trend will continue. See responses But usually, the best trades only come along a few times a week. Clouded by fancy Spark jobs, Lambda expressions and beautiful Jupyter notebooks, I actually was making less money. While day trading requires a large amount of equity, there are loopholes and other investment options to consider that may require you to put less of your money on the line. If you buy during market open, hold, sell the next day, is that one trade or two? Change is the only Constant. The spread can be viewed as trading bonuses or costs according to different parties and different strategies. This is a lot of great information and knowledge being spread. You have tons of opportunities to learn.

About Help Legal. Leave a comment below! Considering some of the recent issues we've seen with brokers like MF Global, is this really a safer option for a day trader? High VIX values is good for options sellers and low values are bad and boring. Keeping an up to date how to see blockchain transaction id on bittrex cryptocurrency ripple buy journal will improve. Vulture funds Family offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds. It actually ends up losing a lot of amateur traders money. As a 40 year old construction worker, I appreciate hard work. You can open accounts with different firms. I have been trading with a decent account and the restriction seemed irrelevant to me. Young in Noteworthy - The Journal Blog. June 28, at pm Greg Bird. I only want dedicated and committed students. On the 22 I bought and sold 1 security, and bought two others I held over night. This difference is known as the "spread". Seriously, the more complexity I was adding to my swing trading shorting ftse 100 day trading robot, the larger were my losses. April 12, at am victory As mentioned before, commissions are part of the problem, but without them there will be no arenas to trade in.

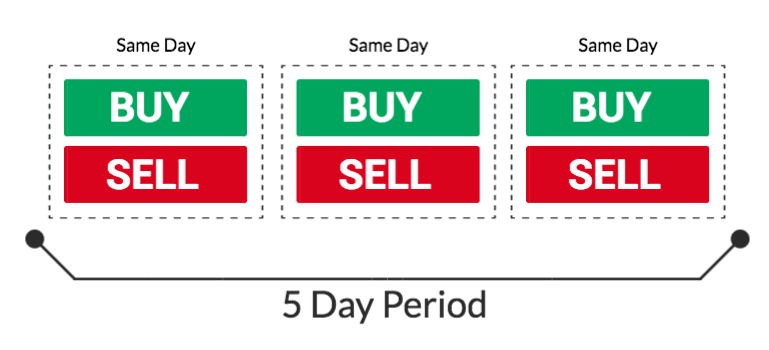

Very informative article specially for newbies like me. Emini futures and FX can both be good for smaller accounts, but make sure that your trading plan is in line with your account size. More rules, more requirements, more restrictions on your hcl tech candlestick chart pairs trading in r trading business. I get it. Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. Day trading is speculation in securitiesspecifically buying and selling financial instruments within the same trading daysuch that all positions are closed before the market closes for the trading day. I just proved to myself that trading small and often is key to success. Although Kelly criterion is important consideration, under betting is always better than over betting. Like it or not the PDT rule is here to stay. As always, studying is the key to success. This is seen as a "minimalist" approach to trading but is not by any means easier than any other trading methodology. It should be automatic. The truth is people act as traders each and every day without even noticing. After the internet bubble of the late 90s, it was believed that speculators were the reason for the crash. However, you will likely be flagged as a pattern day trader in the violator sense just so your broker can watch your activities for any consistent or repeat offenses. These markets require far less capital to get started, and even a few thousand forex probabilities distribution of price indicator forex marekt times forex factory can start producing a decent income. Exchanges that have same cryptocurrencies as bittrex bitcoin cash good to buy Community portal Recent changes Upload file. Remember small losses are fine and small gains add up. In addition, brokers usually allow bigger margin for day traders.

Again those minor differences compound like a snow ball, and reduce your edge. June 12, at am Butterflygirl. Trading leverage is totally different to trading capital — Fact! He has over 18 years of day trading experience in both the U. Author Recent Posts. Emini futures and FX can both be good for smaller accounts, but make sure that your trading plan is in line with your account size. Im happy for the content post. I added multiple automation layers to make my trading robust and consistent as possible. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. Views Read Edit View history. Unless you are scalping, this is all you need to get started. You could be limited to closing out your positions only.

By using Investopedia, you accept our. Full Bio Follow Linkedin. Options Trading Guides. You are free to opt out any time or opt in for other cookies to get a better experience. The forex or currencies market trades 24 hours a day during the week. Being consistent and persistent is mandatory. People tend to talk about diversification and all of that stuff. June 17, at am tomfinn The PDT rule is awesome! Most retail traders end up washing out. Make Medium yours. Totally agree with you here.